Summary

Markets shifted towards ‘risk on’ after US Fed Chair Powell’s comments on Friday were deemed to cement a September rate cut.

Price action may be signalling a rotation in leadership to more cyclical sectors;

Homebuilders are typically interest rate sensitive and have recently begun to outperform popular big tech;

A ‘rotation’ in markets to more economically sensitive sectors has historically been associated with growth phases, though it is not determinative. This may suggest that unemployment rising is not yet a significant concern;

The Modern Family:

In seeking out market signals, we’re as likely to track the Fed’s dot plot, as we are to follow the performance of specific sectors. For example, the ‘modern family’, a term coined by research house Market Gauge, describes the performance of six sectors of primary importance to the US economy – being Retail, Regional Banks, Transportation, Bio-technology , Semiconductors and Retrain Rest Estate…. are showing signs of life. Specifically, the homebuilding sector has some investors´ interest at the moment.

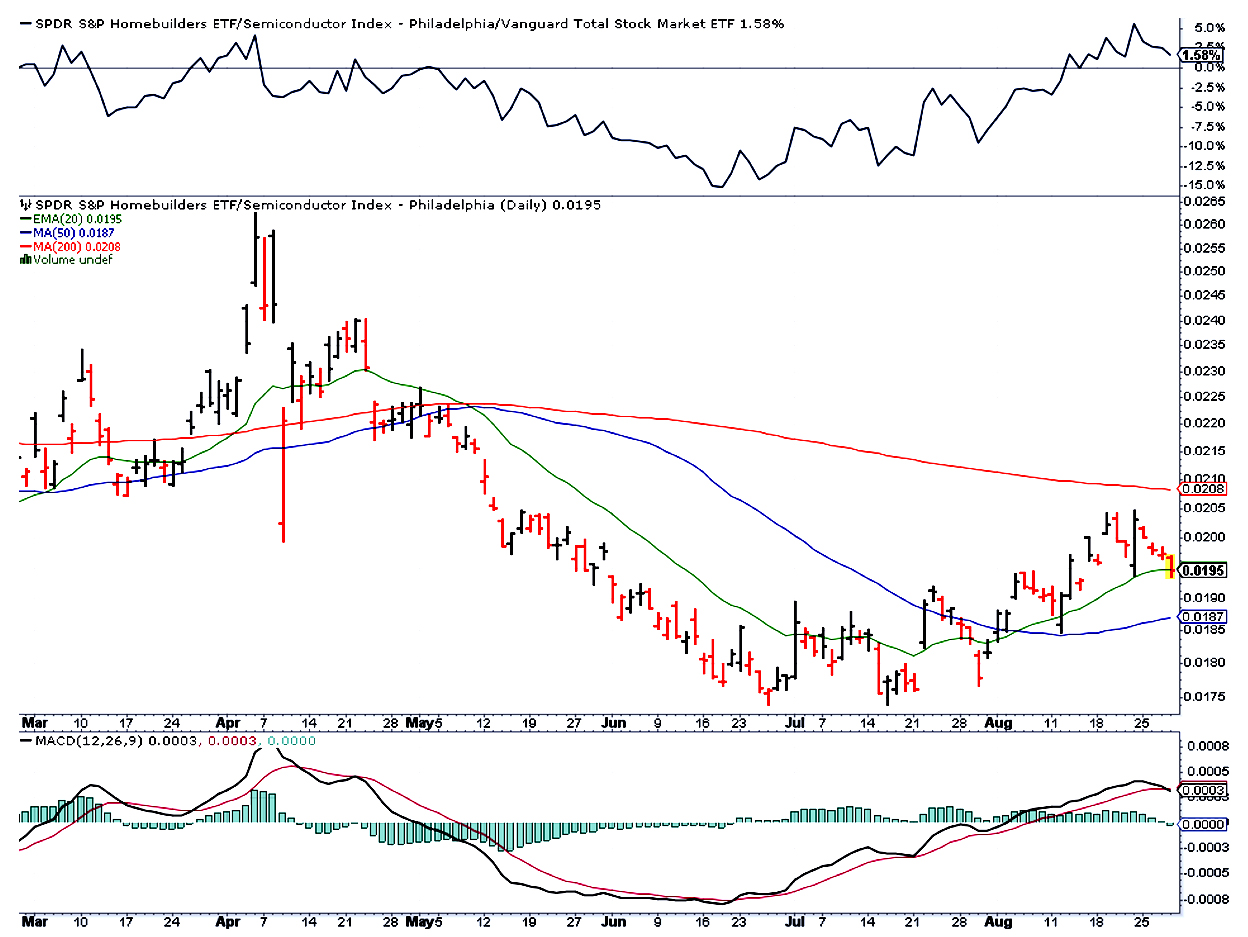

Last Friday saw a rally in stocks and bonds, alongside remarks from Chair Powell noting that inflation may move slightly higher even as the labour market shows signs of loosening. Rather than signalling a conclusion, the moves were viewed by some analysts as an early stage in a broader adjustment. A useful reference point is December 2024, when equities declined and long yields rose in the weeks following a rate cut, with the effects lasting into mid-January. Whilst all eyes inevitably rotate towards big tech, big semi’s, with Nvidia as their bellwether, our analysts sense a subtler rotation could be potentially brewing. That said, it does require cautious optimism given that whilst semi-conductors sit at fresh year-to-date highs, value and equal-weighted benchmarks have only just reclaimed January peaks, whilst homebuilders still trade beneath their 2024 highs.

More telling perhaps is the chart of homebuilders since July. Except for gold miners, no sector has outpaced XHB’s 23 percent surge from its summer depths. And that matters, because homebuilding is closely tied to movements in the 10-year Treasury, not the Fed’s policy rate. Positive price action here may signal more than simple rate-cut euphoria, and it could imply a genuine belief that mortgage costs will decline.

Homebuilder stocks provide an interesting indicator on the markets perception of interest rates, inflation and growth. Higher interest rates tend to pressure homebuilders, while semiconductors have lesser sensitivity to them, whereas the AI story remains well founded. However, should housebuilders continue to lead the pack, market positioning may reflect expectations for easier monetary policy or confidence that growth could offset higher interest rates.

CHART: Semi Conductors versus XHB since June 30th

Source: Stockcharts, ARIA

Residential markets, which account for roughly 17% of GDP, are often seen as both an indicator and a beneficiary of broader economic conditions, a virtuous cycle the Fed are always happy to sustain. Nonetheless, it hinges on jobs: Powell’s “curious balance” in employment must lean toward growth for this thesis to hold.

So we’re keeping a close eye on 10 year government bonds and the housebuilding sectors, on both sides of the pond. If yields break lower, and housebuilders continue to outpace other sectors, markets will have essentially confirmed the Fed’s pivot. Such a move in price action would mirror our QuadLogic data, which is indicating a switch from ‘Quad 1’ where technology stocks rule supreme, to ‘Quad 2/3’, where more cyclical assets take the mantle.

Remember September

However, September is upon us, with corporate yields at all-time lows and volatility very subdued – which might imply the market doesn’t anticipate any disturbances in the near term. Historically, September has been Wall Street’s most challenging month. f XHB falters now, it’ll could suggest a warning that this fragile balance may be as temporary as Friday’s euphoria. It could suggest that growth is unlikely to rebound, rather the new leadership of ‘cyclical’ sectors such as homebuilders and smaller companies may not endure, and investors need not to become detached from their AI fuelled, semi-conductor narrative just yet.